December 2018

This month:

December 2: Hanukkah begins

December 25: Christmas Day

December 26: Kwanzaa begins

January 15: 4th Quarter Estimated Payments Due

Take final year-end actions:

- Deductible gifts

- Capital gains/losses

- Charitable giving

- Dividend income

Happy holidays! Tis the season for family, friends, food, and of course … last second tax moves! While time is running short, consider some of these moves you can make to cut your tax liability. Also, retirement contributions are rising for 2019. The second article lays out the changes for you.

Did you know that there are billions of dollars of unclaimed property each year? Read on to find out how to search for yours. Finally, there’s an article explaining the new qualified business income deduction and what you can do to prepare for it.

Call if you would like to discuss how any of this information relates to you.

6 Last-Second Money-Saving Tax Moves

As 2018 winds down, there is still time to reduce your potential tax obligation. Here are some ideas to make your 2018 tax return less of a burden on your wallet:

- Accelerate expenses. Individual taxpayers are on the cash basis for income tax purposes. This means your income is taxable when you receive it and expenses count when you pay them. Depending on your situation, shifting deductions between years can make a big difference on your tax bill. With this knowledge, making additional deductible payments prior to the end of the year may be a good idea. Examples include property tax payments, mortgage interest payments and charitable donations.

- Make effective use of capital losses. Up to $3,000 in capital losses can be claimed each year to reduce your ordinary income. This loss limitation is calculated after netting all your capital losses against any capital gains. When you have more losses than gains, up to $3,000 can be used to reduce your other income. With careful planning you can take advantage of this loss amount each year.

- Fund tax-deferred retirement accounts. An easy way to reduce your taxable income is to fully fund retirement accounts that have tax-deferred status. The most common accounts are 401(k)s, 403(b)s and various IRAs (traditional, SEP and SIMPLE).

- Take advantage of the annual gift exclusion. For 2018, you may provide gifts up to $15,000 to as many individuals as you wish without tax consequences. This could include gifts of cash or property, including investments. Taking advantage of the annual exclusion is a great way to lower your taxable estate.

- Give to charities. Consider making end-of-year donations to eligible charities. Donations of property in good or better condition and your charitable mileage are also deductible. Receiving proper documentation that acknowledges your contributions is important to ensure you obtain the full deduction. Have a plan by knowing your total deductions for the year to help you decide how much to donate. Pulling some donations planned for 2019 into 2018 may be a good strategy.

- Donate appreciated stock. By donating appreciated stock owned one year or longer to a favorite charity, you receive two benefits. First, you will not have to claim the capital gain on the appreciation of your investment. Second, you can claim the higher market value of the stock as your contribution amount. The procedure you need to follow to qualify your donation of appreciated stock is fairly strict. Ask for help from your broker and the charitable organization to ensure it is done correctly.

This is a short list of some of the ideas you can use to lower your tax obligation in 2018. If interested, please call for help with reviewing your situation.

Retirement Contributions Get a Boost in 2019

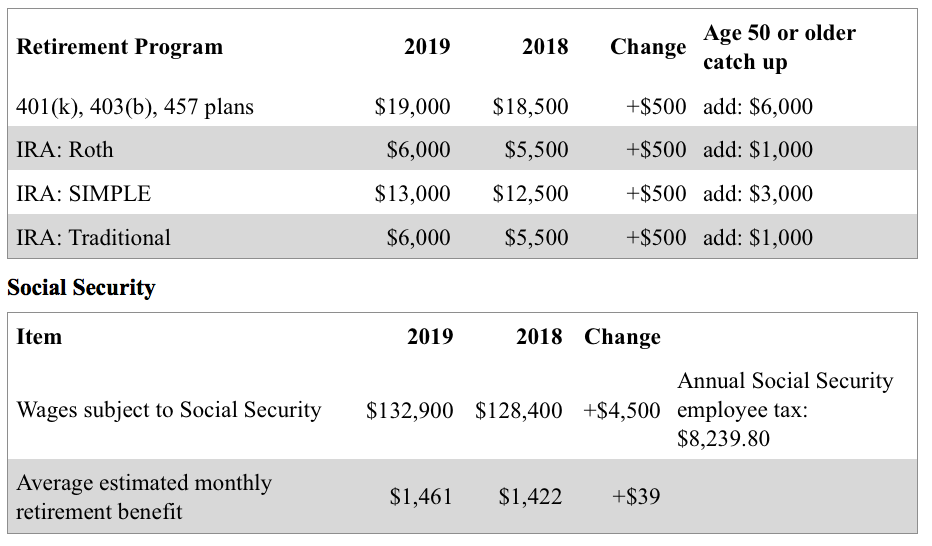

For the first time since 2013, the IRS is raising the contributions limits for IRAs. The maximum contribution for 401(k) accounts and IRAs is increasing by $500 for 2019. If you have not already done so, now is the time to plan for contributions into your retirement accounts in 2019. Check out the tables below for the new contribution limits and Social Security increases:

Retirement Contribution Limits

Don’t forget to account for any matching programs offered by your employer as you determine your various funding levels for next year.

It’s Your Money. Get it Back NOW!

According to Credit Karma, over $40 BILLION of unclaimed property is currently being held by state governments. That’s a staggering amount of money – enough to buy half of the National Football League franchises. Not included in that figure is property sitting with federal agencies and other organizations. So what exactly is unclaimed property and how do you find out if you have any? Here is what you need to know:

What is considered unclaimed property?

There are two main types of unclaimed property:

(1) IOUs. Money that is owed to you that you haven’t claimed.

(2) Forgotten funds. Money sitting untouched in an account for an extended amount of time.

Specific types of unclaimed property include back wages, life insurance, pensions, tax refunds, bank accounts, money orders, gift certificates and security deposits. For example, many states require banks to turn over funds from checking accounts that have been dormant for over three years.

Tips for managing unclaimed property

- Search state and federal databases. Unfortunately, there is no master database to search for unclaimed property. There is a website called Missing Money endorsed by the National Association of Unclaimed Property Administrators (NAUPA) that can search most states at once, but each state maintains their own database. Be sure to check all states where you have been a resident. More information is provided online by the US government to help track down additional types of unclaimed property.

- Don’t pay a company to search for you. Companies are willing to search for unclaimed property for you, but will charge a fee. All unclaimed property data is public information, so anything a search company can find, you can find as well. In most cases, it’s best to conduct the search yourself.

- Watch out for scams. Be wary of any notices alerting you to unclaimed property that can be yours for a fee. Often times these scams will ask you to send them money with the promise of more money in return. The Federal Trade Commission (FTC) has some tips to help you spot an imposter.

- Take steps to avoid having your property become unclaimed. The best way to keep your property is to prevent it from becoming unclaimed in the first place. Some ways to do this is to actively manage bank accounts, notify companies when you move, close old accounts, and read all of your mail so you don’t miss a claim notice.

- File your tax returns. Consider filing a tax return even if your income is below the requirements to file. Unclaimed refunds with the IRS usually happen when a tax return isn’t filed with one of two situations: your employer withheld income tax from your wages or you qualify for a refundable portion of the Earned Income Tax Credit. The only way to know for sure is by filing a tax return for the year in question. If you have past tax returns to file, don’t wait — overdue tax returns need to be filed within three years.

Any unclaimed property due to you is rightfully yours and should already be in your pocket. Perform regular searches to ensure that your funds aren’t sitting in a government account.

Early Warning Signs of a Tax Problem

There are many factors that can cause an unfavorable tax swing leaving you with a surprising tax bill in the spring. Here are six warning signs that you might have some unexpected taxes waiting for you.

- You didn’t update your W-4

You may have noticed a change in your tax withholdings earlier this year. These changes are based on withholding tables rolled out by the IRS to employers in early February. Now, according to the U.S. Government Accountability Office (GAO), as many as 30 million taxpayers may not have adequate withholdings for 2018. If you have not already done so, review your withholdings in light of the new tax laws. - You withdraw funds from an IRA before you’re 59½

Situations arise where you need to dip into your retirement savings to address an immediate need. When this happens, it might have major tax implications. This includes:- The withdrawal may be subject to a 10 percent early withdrawal penalty.

- The funds withdrawn will be taxed at your highest (marginal) tax rate.

- The additional income may push you to a higher tax bracket or bump you over tax-benefit phaseout thresholds.

- You receive a large raise early in the year

While the raise means more income for you, it also means more taxes due to the IRS. Depending on how much more income, it might be taxed at a higher rate than your income in previous years. The tax brackets are built-in to the IRS withholding tables, but they don’t take your entire situation into account. - You have a second job

Making some money on the side is a great thing, but can be a major tax problem if you don’t plan properly. In addition to being taxed as ordinary income, it might be subject to self-employment tax of 15.3 percent! Plus, withholding rules start over for each job and do not account for any other income you receive. - Your child turns 17

One of the biggest tax benefits that come by having dependent children is the Child Tax Credit. In the year your child turns 17, they are no longer eligible for this potential $2,000 credit. What’s more, personal exemptions are suspended for the next few years. So you may not only lose an exemption for this child, you now will not receive a Child Tax Credit. - Your standard or itemized deduction is lower

While the standard deduction is nearly double to $12,000 ($24,000 for married filing jointly) for 2018, personal exemptions are suspended. In addition, many itemized deductions are either limited or eliminated! This can create a vastly different amount of taxable income versus last year. While tax rates are generally lower, there will be more than one surprised taxpayer that sees an expected tax refund turn into a tax bill.

So what can you do? If any of these situations apply to you, now is the time forecast your income and deductions for the year and estimate your tax liability. If your withholdings are falling short, there is still a little time to update your paycheck allowances for a pay period or two or make an estimated tax payment.

5 Tips to Keep Your Customers Coming Back

Happy, satisfied customers are essential to the health of every business. Increasing competition, online review opportunities, and unlimited access to information up the ante on the importance of quality customer service. Here are some tips to help your business thrive by meeting and exceeding your customers’ expectations:

- Truly understand your customer and their needs. As best you can, put yourself in your customers’ shoes and hone in on the need they are trying to meet with your product or service. Understanding their core need will help you with delivery timelines and provide a clear picture of what it will take to ensure they are satisfied enough to come back.

- Set clear goals and expectations. Once you understand their needs, be clear and transparent regarding the process to deliver your product or service. Set realistic goals and discuss potential delays and pitfalls. Your customers will appreciate the honesty and may even be more understanding if things don’t go according to plan.

- Communicate, communicate, communicate. Keeping your customers from feeling in the dark is imperative to their satisfaction. Be proactive in your communication. The more forms of communication, the better – phone calls, text messages, emails and social media messages. Even if everything is going to schedule, regular “progress” messages will help them feel at ease.

- Go the extra mile. Put in the extra effort to go above and beyond what your customers are expecting. At the end of the day, you want your customers to feel like they get what they pay for, and more. If a problem arises with the product or service, show them you care by prioritizing and rectifying the situation. If at all possible, consider adding something of value to leave a positive impression.

- Add a personal touch and be authentic. In a world of social media bots, augmented reality and alternative facts, authenticity goes a long way. Showing your customer you care builds trust and loyalty that leads to repeat business and referrals. Birthday greetings, holiday cards and customer appreciation events can show your customers they mean more to you than just revenue.

When times are busy, it can be easy to focus on the work and not the customers. Hold on to these tips as a reminder to keep your customers’ needs a top priority.

The New Business Deduction

Stop worrying and start preparing

A new deduction is available to businesses with qualified business income (QBI). While that’s great news, new deductions (especially ones with lots of rules) can bring anxiety and confusion. Never fear! Ensuring you receive a maximum deduction will come down to providing the proper information. Here is some knowledge to help you cut through the confusion:

What is the QBI deduction?

In short, it’s a 20 percent deduction against ordinary income, taken on your personal tax return, that reduces qualified business income earned for most pass-through businesses (sole proprietorships, partnerships and S-corporations). It’s not an itemized deduction, so you can take it in addition to the standard deduction. To qualify without limitations, your total taxable income needs to be below $157,500 ($315,000 for married couples) for 2018. If your income exceeds the threshold, it gets complicated.

What you need to know:

- If your total taxable income is above the income threshold, your deduction may be limited or nullified. If your income is below the threshold, the calculation is pretty straightforward. If not, additional phaseouts, limitations and calculations come into play. The first limitation to consider is whether or not your business is qualified. Certain specified service trades or businesses (SSTBs) are excluded from the deduction altogether if taxable income is over the threshold. If your business is not an SSTB, other calculations related to W-2 wages and basis in qualified business property may be required.

- Schedule K-1s for S-corporations and partnerships have new codes. Businesses with partners and shareholders are now required to report information related to the QBI deduction on each Schedule K-1 they issue. Based on the draft versions of the forms, the new codes will be in Box 17 for S-corporations (V through Z) and Box 20 for partnerships (Z through AD). If you receive a Schedule K-1, check to see if the new codes have values associated with them. If not, contact the issuing business to correct the mistake. Schedule K-1s without the required data will delay your tax-return filing.

- Certain data needs to be collected. For the most part, the data required to calculate your deduction will be included on the normal forms needed to file your taxes. Here is list of common documentation to watch for that may be required to calculate your QBI deduction:

- Business financial statements

- Forms W-2 and W-3 issued by your business

- Purchase information related to business assets

- Schedule K-1s

- Forms 1099-B with cost/basis information

- The sooner you close your books, the better. The new deduction means more work. Knowing your final business net income as soon as possible gives you extra time to work through the additional necessary calculations. If your business is required to issue Schedule K-1s, even more time may be required.

- More guidance is expected from the IRS. In August, the IRS published guidance to clear up some of the confusion regarding the deduction, but it didn’t cover everything. The American Institute of CPAs (AICPA) responded with 11 specific items that still need to be addressed.

With proper planning and preparation, you can rest easy knowing that obtaining your shiny, new QBI deduction is in good hands.

As always, should you have any questions or concerns regarding your tax situation please feel free to call.